How Should My Company Evaluate Real Estate Transactions?

Last week I had the privilege of attending two CoreNet seminars in Dallas. These seminars focused on the financial evaluation of corporate real estate and real estate's impact on a company's financial statements. These seminars were excellent and thoughtful reviews of the way real estate professionals should evaluate and think about corporate real estate financially. In this post, I figured I would share some of my thoughts on the topic, including the many lessons learned, and rekindle the news portion of these posts. I hope you enjoy this one and, as always, your feedback is appreciated!

The primary objective of the supply chain real estate professional is to align their real estate portfolio with their company's objectives. Alignment of real estate and overall business targets can be a complex process involving a wide variety of corporate stakeholders, including corporate finance, operations, and capital markets. This process can often be reduced to balancing efforts to reduce expenses and drive revenue.

How does one execute this balance? By using the universal language of companies...finance. Finance is forward looking and focuses on generating cash from operations, return on investment value, and forecasting metrics.

Discounted Cash Flows

Central to the idea of finance is the concept of the time value of money, which involves a cash flow over periods of time and an appropriate rate of risk to discount them, otherwise known as a discounted cash flow (DCF).

Creating Cash Flows

Cash flows should be estimated on the professional's best projections (guess). Risk should be accounted for in the discount rate(s), where it can be adjusted over the entire investment or a particular phase of the investment. For example, if a company is considering the purchase of a property and they are believe the risk at the disposition phase of their investment is high, they should adjust the discount rate for that phase so that all cash flows within that phase will be property adjusted for the risk.

For occupiers, a DCF with just real estate cash flows does not show the operational profitability of the real estate. Most supply chain real estate professionals will be familiar with a negative net present value (NPV) for a lease DCF. This is may be acceptable for comparing leases to determine the least negative net present value. However, the lease with the least negative net present value should not be interpreted is the best option for the company. In order to fully examine the real estate opportunity, operational cash flows and tax impacts should be incorporated.

DCFs can have multiple discount rates throughout the time frame of a DCF. For example, you can assign different discount rates for certain phases of a real estate hold such as the purchase, refinance, retrofit, and disposition of the asset.

Establishing the Appropriate Discount Rate(s)

The risk rate, commonly called the discount rate, should be based upon the most appropriate rate of risk for similar investments. For example, a lease with a company is very similar to owning a debt obligation with the company. The company has promised, through a lease, to pay certain amounts over a period of time-just like a bond without the principal payment at the end of the term. Therefore, the appropriate discount rate for such a lease is most likely the company's cost of borrowing.

Company's typically should NOT use their weighted average cost of capital (WACC) as their discount rate for real estate DCFs, because it is not indicative of the risk inherent a real estate transaction. A company's WACC is their market cost of capital (blend of their cost of debt and equity).

Risk can also rise and fall depending on whether the length of the real estate obligation matches the company's planned period of use. For example, a higher discount rate may be appropriate if a company enters a real estate lease or sublease with a planned period of use less than the lease or sublease term.

Common Metrics

Modified Internal Rate of Return (MIRR)

Impact on Financial Statements

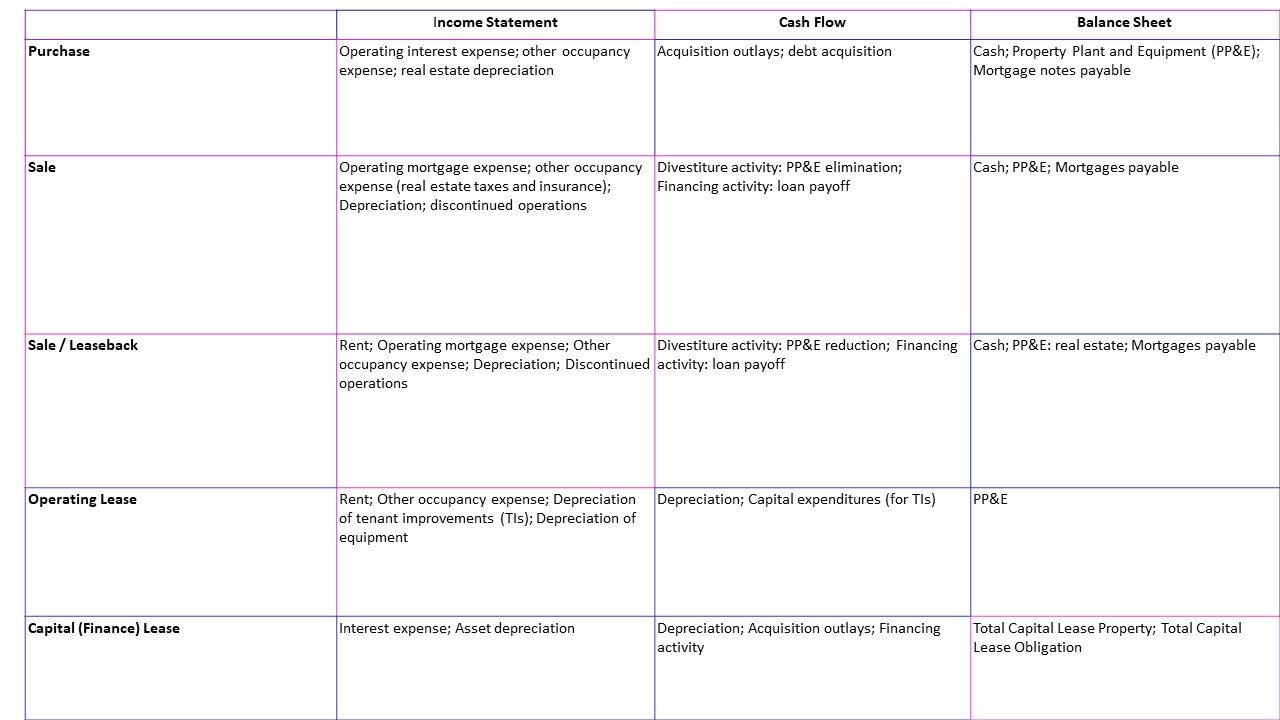

If real estate cash flows examine the cash impacts of a company's real estate, real estates impact on financial statements are the overall scorecard. For the supply chain real estate professional, understanding how real estate affects their company's financial statements is required in order to properly evaluate their real estate portfolio and options.

Financial Statements

Financial statements typically exist in three forms; the income statement, the cash flow statement, and the balance sheet. It is important to understand that all three forms are connected but separate statements of a company's financial well-being.

The income statement, which is also referred to as a profit and loss statement, shows the company's revenue, expenses, and net profit over a period of time. On the income statement a company will record figures such as its sales, cost of goods sold, gross profit, and earnings per common share.

A cash flow statement shows the impact on cash over a period of time. It has three parts including the cash from operating activities, investing activities, and financing activities.

Finally, the balance sheet details the company's assets, liabilities and stockholder's equity. Unlike the income statement and cash flow statement, the balance sheet is a snapshot in time. Typically the balance sheet will be produced at the end of a fiscal year.

There are several basic accounting principals which apply to financial statements. One primary accounting principal is the adherence to certain accounting oversight or guidelines such as FASB, IASB, GAAP, and IFRS. Other basic accounting principals include periodicity, cash or accrued measurement, reporting, materiality, substance versus form, and depreciation. From these principals we are able to understand how financial statements are constructed and reported.

Real Estate Impacts on Financial Statements

The impact of real estate on financial statements is determined by the accounting oversight and guidelines followed by the company. Companies generally will use FASB, IASB, GAAP, or IFRS depending on the location of where their stock is traded or their headquarters is otherwise domiciled. The impacts of the following real estate transactions are, unless otherwise noted, specified by FASB and GAAP.

The difference between an operating and capital (finance) lease is important for accounting purposes. The Statement of Financial Accounting Standards No. 13 (FAS 13) explains the process for determining whether a lease is an operating lease or a capital (finance) lease. A capital (finance) lease is a lease which fits any of the following criteria:

Automatic Transfer of Ownership

Bargain Purchase Option

Term > 75% of the Useful Life of Building

PV Rent > 90% of Fair Market Value

An operating lease would not fit any of those criteria. The impact of whether an operating or capital (finance) lease can be profound on financial statements, particularly the Balance Sheet. The affect of a capital (finance) lease on financial statements is:

It is on the Balance Sheet (similar to a purchase with 100% financing)

Ratios using assets and liabilities are affected (ROA, ROE, DCR)

Depreciation + interest expenses exceed rent at the beginning

Generally unfavorable accounting

It is not that a capital (finance) lease is good or bad. The important thing for a supply chain real estate professional is to communicate with their Finance Department when they are considering a lease to make sure the lease is defined as an operating or capital lease and it aligns with the company's financial objectives.

Lastly, in order to your company's financial objectives it is important to know if your company is income statement or balance sheet driven. An easy way to determine if a company is balance or income statement driven is to look at how many charts detail income sheet or balance sheet metrics in an annual report.

If your company is income statement driven, it will focus on earnings and expenses in order to understand if the company is profitable. Growth companies often are income statement driven as investors will often care more about how much the company has grown and limited expenses over the prior year than their return on existing assets. Metrics such as Earnings Before Interest Taxes Depreciation and Amortization (EBITDA), EBIT, Earnings per Share (EPS), and Price to Earnings (P/E) are based on the income statement.

Conversely, if your company is balance sheet driven, it will often focus on returns on its assets and liquidity. Balance sheet driven companies are often mature, established companies whose investors care about obtaining a return on existing assets at the end of a financial period. . Metrics such as Return on Assets (ROA), Current Ratio (CR), and Quick Ratio (QR) are based on the balance sheet.

Upcoming Changes in Lease Accounting

On February 25, 2016 FASB issued Topic 842 which stated that all operating leases will be capitalized (on Balance Sheet) starting in fiscal years following December 15, 2018. Practically, companies will need to capitalize the prior two fiscal years in order to provide a coherent accounting history. The current operating and capital (finance) leases will be re-categorized into Type A Finance Leases and Type B Operating Leases. Both will be on the balance sheet, but treated differently.

Under Topic 842, Type A and Type B leases are treated as follows on the Income Statement and Balance Sheet:

Income Statement: Type A lease has no impact on rent but does have an interest plus amortization expense. Type B lease will have a single lease cost expense in the form of straight line rent.

Balance Sheet: Type A lease will have an asset depreciation in the form of straight-line amortization and liability determined by the effective interest method. Type B lease will also be on the balance sheet in the form of asset depreciation but the impact will be balanced out by increasing amortization balances to straight-line rent less interest.

Capitalizing both types of leases involves determining the term, which is the non-cancellable period, options are included if reasonably certain, variable lease payments, operating expenses, and discount of the Lessee's incremental borrowing rate.

While most supply chain real estate professionals will not need to calculate the accounting impact of either type of lease, the important points to know are:

All leases will be capitalized and on the balance sheet

Type B lease will have a balancing effect on the balance sheet

Lease term will have a significant impact on the income statement and balance sheet

Just Hit Go! today to discuss how we can help your company understand the financial impacts of real estate decisions!