Why Some Commercial Real Estate Lease Structures are Better than Others-Lease Termination Options

In my previous post, I discussed how the length of a commercial real estate lease impacts the operational and financial considerations of a company or customer. This post is sort of an addendum to that post, since what I want to talk about is the lease termination option and its use in commercial real estate.

A lease termination option is a right held by the tenant, landlord, or both to end the lease prior to its scheduled expiration. Because they create uncertainty for the opposing party to a lease, lease termination options are one of the most challenging option rights to negotiate into leases.

Below I will discuss some of the reasons why options to terminate are desirable, their common types and structures, and analyze their use in commercial real estate transactions. Lease termination options can be negotiated into some lease agreements under certain conditions. Perhaps more than any other option right, in order to successfully negotiate a lease termination option to terminate the party desiring the right must have an awareness of the negative implications for the other party, and a willingness to provide reasonable solutions to address those implications if required.

Why Do You Need a Lease Termination Option?

Tenants and landlords usually have different stated reasons for desiring a lease termination option. However, at the most basic level they share the same reason, which is uncertainty regarding future events.

Why Tenants and Landlords Want the Right to Terminate

Tenants typically desire lease termination options to address uncertainty in their business, real estate portfolio, or environment. This could mean that the tenant is uncertain about the utility of a property for the entire length of the lease term, and wants the right to end its obligations after a certain period of time.

Landlords may also request termination rights to address uncertainty with the future of the property and current tenancy. For example, some landlords request a right to terminate if a neighboring tenant may expand into the Premises at some point during the lease term, usually when a much larger tenant needs to expand into a smaller space.

How unpredictability manifests itself in specific examples, such as property utility or property repositioning, usually determines the lease termination option's type and structure.

Types and Structures

Regardless of which party holds a lease termination option, there are two main types. Each type depends on the conditions by which it can be exercised.

The most common type of lease termination option is exercised by notice to the other party. These would include ongoing options, where notice could be provided at any point during the term, and scheduled options, where notice can only be provided during a specific period during the term.

The second type of lease termination option can only be exercised when a specific event takes place during the lease term. These would include co-tenancy, where a retail tenant has the right to terminate if a neighboring tenant vacates; bailout, where a retail tenant has the right to terminate if its sales do not meet a certain threshold; and re-capture, where a landlord has the right to terminate a tenant's lease obligations in the event of an assignment or sublease. These options are typically not automatic terminations of the lease and usually are subject to additional notice from the holder in order to be exercised.

Types of Lease Termination Options

There is no limit to the ways a lease termination option might be structured theoretically. However, lease termination rights are often constrained or unavailable in reality depending on a number of factors, not the least of which is the willingness of the party not holding the right to consider conferring such rights to the other party.

Practical Analysis of Lease Termination Options

Since lease termination options give a party the ability to end their lease obligations prior to the expiration of the lease, in order for one party to accept another party's right to hold such an option, it can be assumed the party not holding the option has been sufficiently compensated. While monetary compensation, such as a termination fee, is common it is not the only consideration in most instances.

In fact, the inclusion of a lease termination option in a lease is arguably determined more by whether its inclusion is supported in the marketplace than the amount of monetary compensation provided if it is exercised. Landlords, for example, will be resistant to a tenant holding a lease termination option in a market where landlords would not need to provide one to obtain a market lease term. This is a very common situation in the top U.S. industrial markets when a tenant wants a 5 years lease term with an option to terminate after 3 years, and the market lease term is 5 years or more. The landlord has no market incentive to provide the lease termination option when they most likely can find another tenant who will not require one.

The notable exception to the market "exclusion" of lease termination options is when a tenant's credit is substantial enough, and perhaps the tenant's footprint large enough, to override market concerns. Some credit tenants reportedly are able to negotiate a lease termination option in almost all of their leases, regardless of market or landlord.

The table below lists some of the concerns tenants and landlords might have when they consider, negotiate, and exercise a termination right during the lease term.

A few concerns that are often missed in consideration of termination options are the impacts to budgeting and financial statements. For landlords and tenants, a lease termination option can frustrate their ability to properly budget for upcoming fiscal years. This is especially true for institutional landlords, whose asset managers are often responsible for creating projected fiscal budgets based upon anticipated cash flows within their portfolios. Such asset managers will try to avoid accepting option rights which create cash flow uncertainty inside of the contract lease term.

Notice in a Lease Termination Option held by the Tenant

Assuming the landlord is amenable to a tenant holding a lease termination option by notice, they typically would need to negotiate how the termination option can be exercised and the fee involved for doing so. Ongoing rights to terminate are exceedingly rare because of the uncertainty it creates for the other party. Therefore, most lease termination options by notice will have a specific period in which the tenant or landlord can exercise their right to terminate.

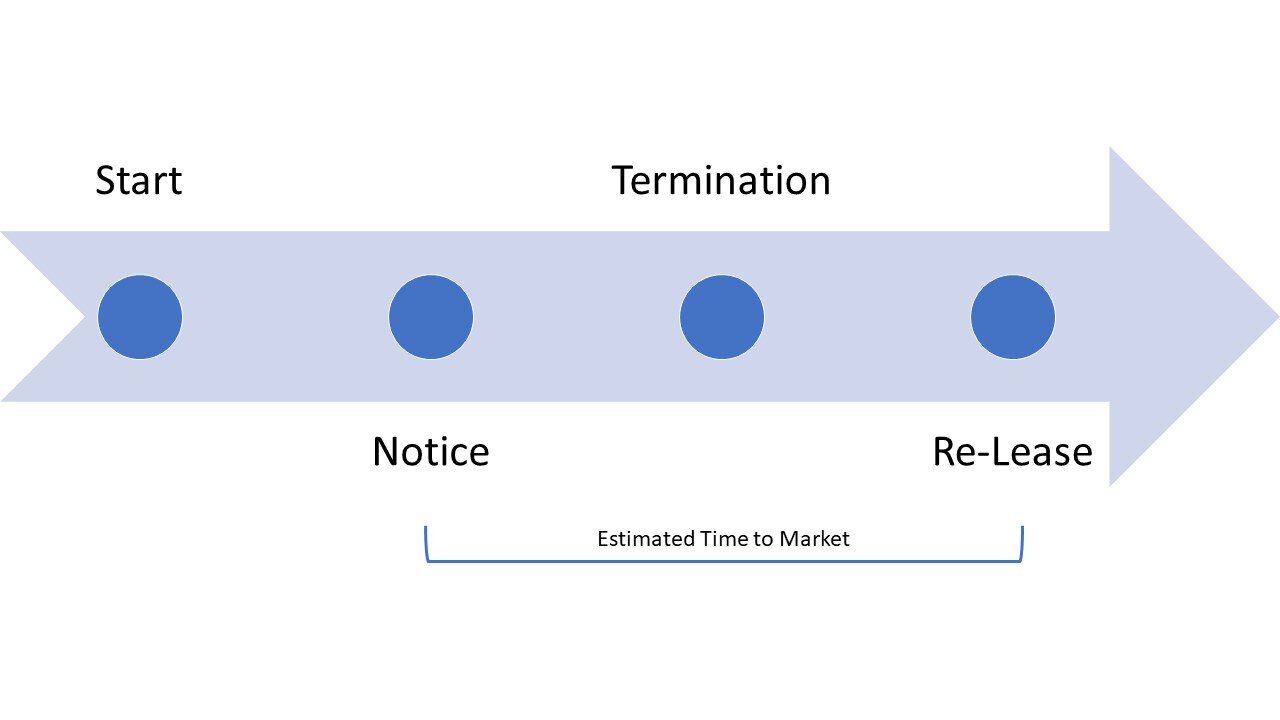

One of the landlord's primary concerns is the amount of time it will take to re-lease a property to another tenant once the a lease has been terminated. The timeline below shows a simple lease termination and lease-up process where the tenant would provide notice by a certain date, the lease would terminate, and the subject space would be re-leased by another tenant. A landlord, in such a scenario, would try to mitigate vacancy or the period of time between the termination of the existing lease and the re-lease of the subject property.

Lease Termination with Equal Time Between Notice Expiration, Termination, and Re-Lease

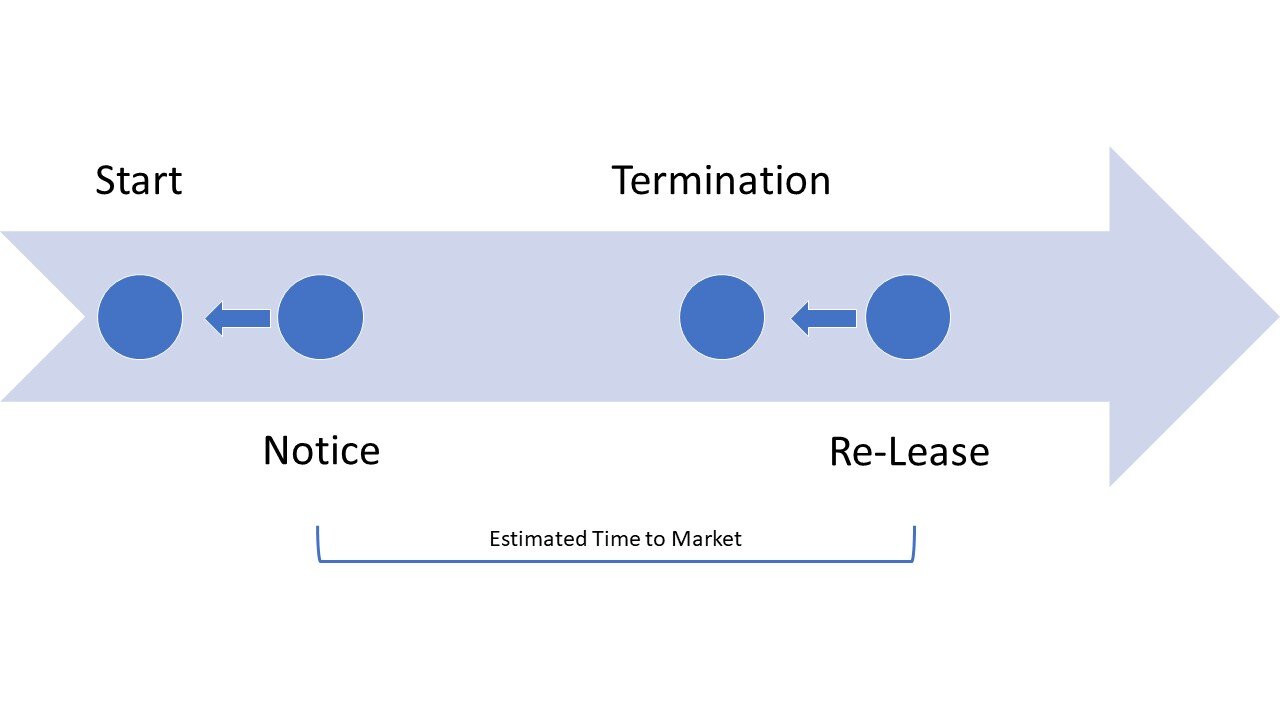

Lease Termination with Greater Time Between Notice Expiration and Termination, and Less Time Between Termination and Re-Lease

In the context of the lease termination option negotiations, a landlord can mitigate vacancy by increasing the amount of time between the date the tenant must give notice of terminating the lease and the actual termination of the lease. However, increasing the time between the notice date and the termination can create uncertainty for the tenant. The earlier the notice date, the more likely the utility of the lease termination option is diminished because the tenant will be less certain about whether they should exercise it.

In my experience, lease termination options commonly have a structure where the tenant can exercise anywhere between 6 to 9 months prior to the termination date. This period is often small enough for a tenant to know whether it should terminate the lease and long enough for a landlord to have enough time to start marketing without significant concern about vacancy.

Termination Fees in a Lease Termination Option held by the Tenant

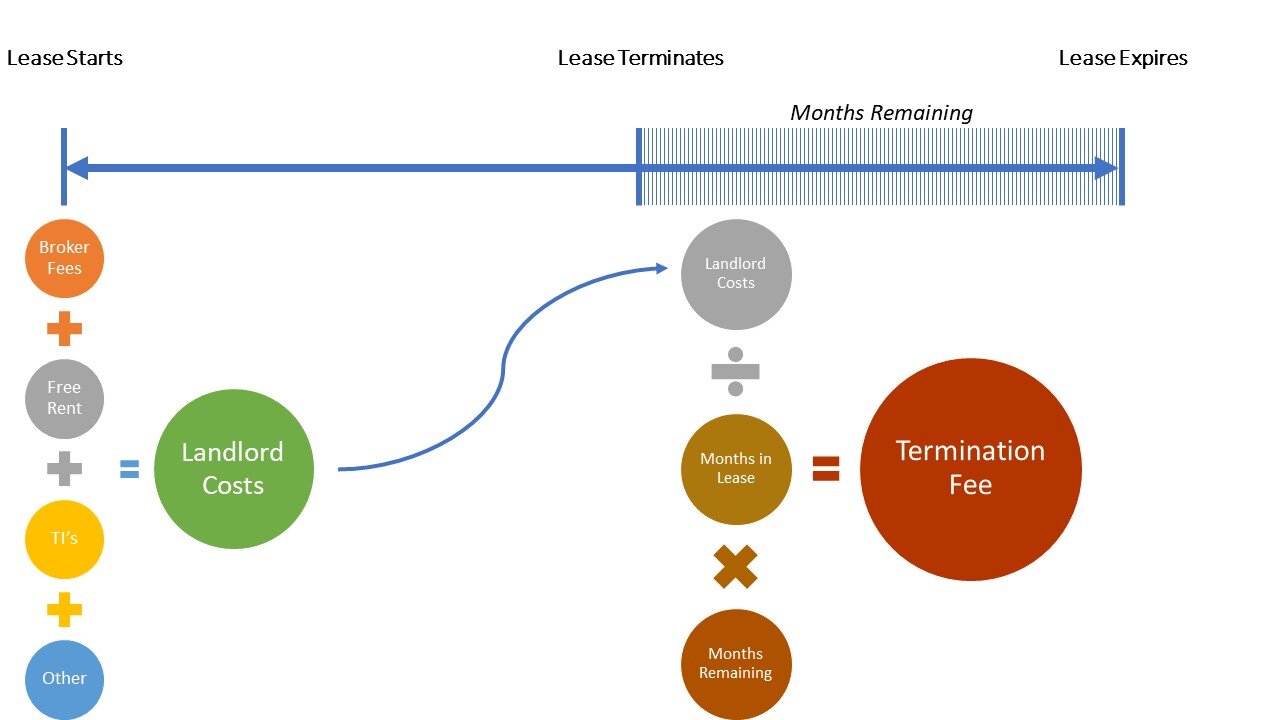

There are many methods to determining an appropriate termination fee for the tenant to pay in exchange for exercising its lease termination option. The most common method, in my experience, is equating the termination fee to the landlord's costs to lease the property, prorated over the months remaining in the lease term following the termination, as the graphic below demonstrates.

Termination Fee Equal to Unamortized Landlord Costs to Lease

This method of determining the termination fee is compelling for both tenants and landlords. The landlord can reasonably amortize their costs over the entire lease term, not just up until the lease terminates, knowing any unamortized costs will be reimbursed if the tenant terminates the lease. Since the landlord can amortize their leasing costs over the entire lease term, the tenant can usually receive a greater amount of leasing incentives than they would without such a termination fee.

Although the above method is common, there are many other ways to structure a lease termination fee. Starting with no fee at all, possible lease termination fees include a nominal fee for legal and processing costs up to the present value of remaining obligations plus any initial costs. At a certain point, the termination fee becomes unattractive to the holder of the termination option because it is equal or greater than the remaining obligation or an alternative transaction such as a sublease or assignment becomes better financially.

Increasing Termination Fee Structures

Lease termination options are one way to address uncertainty from both the tenant or landlord perspective. Although they are not always possible to obtain in certain negotiations, if structured with reasonable notice periods and termination fees where required, they can help a tenant or landlord commit to a longer term lease while allowing for flexibility in the event one party needs to terminate before the scheduled lease expiration.

Just Hit Go today to discuss how we can negotiate lease termination options to give your company the flexibility it needs in its next new lease or lease renewal!