Why Some Commercial Real Estate Lease Structures are Better than Others-Length of Lease Term

In the previous post I reviewed why commercial real estate lease structures are important to our companies and customers, what measurements we can use to evaluate commercial real estate lease structures, and how we can best measure those lease structures in certain situations. In this post I will cover why lease terms matter to tenants and landlords and what a longer or shorter lease term does to the measurements we discussed in the previous post.

Why Lease Term is Important

At its most basic level, lease term is simply the time period during which one party grants property rights to another party in exchange for compensation, typically in the form of rent. While the amount of rent paid during the lease term partially depends on the length of term, there are other important considerations for both the tenant and landlord. The following table provides some other examples of reasons why lease term can be important to the tenant or landlord.

For the tenant, there are several reasons why lease term matters. The majority of those reasons center around its anticipated utility of a property, retaining flexibility within its real estate portfolio, to assist in cash flow and other finance related objectives, and to maximize the amount of benefits they receive in a lease negotiation.

The landlord looks at lease term primarily as a commitment by the tenant to pay rent for a certain period of time. However, they also are concerned with secondary impacts of lease term on things like selling the property, financing or re-financing the property, and amortizing tenant improvement allowances or other tenant inducements.

For both tenants and landlord the market lease term likely has the most common impact on what each will be able to negotiate and accept. In markets where lease terms are always a minimum of five years, it can be difficult or impossible to secure a three year term unless there is an extraordinary benefit to the landlord. Extraordinary benefit can include higher rents, higher or more frequent rent adjustments, limited to no tenant inducements, and finally and especially a superior credit company or existing landlord customer. On the other hand, if three year terms are often done in a market and a landlord mandates a minimum of a five year term, their property can sit vacant until they find a tenant is willing to do a five year term or the landlord removes the mandate.

Lastly, property type can determine lease term length as well. Ground leases where the tenant will improve the property are typically long term leases, usually between 20 and 99 years in length, in order to amortize the cost of improvements over a longer period of time. Specialty property types such as cold storage, food processing, health/science, and data centers commonly have longer term leases for several reasons, including the amount of investment required to suit a tenant's specific needs.

How Lease Term Affects Metrics

Variance in lease term does not impact all of the real estate metrics we discussed in the last post. Metrics impacted in leases regardless of the length of lease term include:

Total consideration

Discounted cash flows

Net present value

Net present value rate

Those metrics impacted by lease term in certain lease structures include:

Straight-line rent

Effective rate

The reason lease term impacts the first four metrics but not necessarily straight-line rent and effective rent is because straight-line rent and effective rents are averages, and averages will not change when lease term varies unless there are adjustments to the rent over the term.

For example, the graph below plots the effective and NPV rates (@6% discount rate) for a lease with a $1.00 per square foot start rate, no rent adjustments, and no free rent for 36, 60, 120, and 240 month lease terms. As the graph shows, the effective rate remains the same no matter what length of lease term while the NPV rate declines. Even though NPV rate is an average of the net present value per unit of size per unit of time, it is still derived from net present value which discounts future cash flows to the present.

Effective and NPV Rates (@6% discount rate) assuming $1.00/SF start rate, no rent escalations, no free rent, and no tenant improvement allowance

To show the changes to all the metrics mentioned above, we will assume in the following examples that there are changes in rent over the lease term.

Example 1-Lease of 100,000 SF Industrial Building in a Top Industrial Market

Let's look at what an adjustment to lease term would do to the metrics for a recent renewal lease transaction for a Class A distribution building in the South Bay industrial submarket of the Greater Los Angeles Basin industrial marketplace:

115,286 RSF

$1.02/SF Net start rate (monthly) / $12.24/SF Net start rate (annual)

3% annual rent escalations

No rent abatement

No tenant improvement allowance

Graphic 1

Graphic 1 above shows the noted metrics when lease term is 36, 60, 84, 120, and 240 months for Example 1. You will likely notice a few trends right away:

Total consideration, effective rate and NPV all increase with the growth in lease term

NPV rate declines with the growth in lease term

The rate of increase in total consideration is greater than the rate of increase in NPV as the lease term grows

The effective rate and NPV rate appear to be diametrically opposed positive and negative rates of growth

These trends are due to the discounting of future cash flows in the NPV and NPV rate metrics, or the lack of discounting of future cash flows in total consideration and the effective rate metrics.

Given the variability in the direction and amount of each metric in Example 1, we need additional information in order to determine what lease term is better for the company or customer. Total consideration, NPV, and effective rates would show in isolation that the 36 month term has lower amounts for a tenant, while NPV rate would show leases longer than 36 months have lower amounts for a tenant. Since we need additional information in order to determine what metric is useful for comparison purposes, the metrics lose their effectiveness in Example 1.

So how can we identify when metrics are effective tools to compare leases and avoid the obscurity in Example 1? Real estate metrics are typically much more useful in isolation when:

Comparing different properties with similar or equal lease terms;

Comparing proposal histories for the same property with similar or equal lease terms

Example 2-Analyzing Different Properties with Similar Lease Terms

Let's assume the tenant who renewed the lease in Example 1 considered two alternative available spaces. They sent a letter of intent to all three landlords proposing a five and seven year lease term summarized as follows:

Current Location

115,286 SF

61 Month Lease Term

$1.00/SF Net start rate

3% annual rent escalations

1 month of rent abatement

No tenant improvement allowance

86 Month Lease Term

$0.98/SF Net start rate

3% annual rent escalations

2 months of rent abatement

$0.50/SF tenant improvement allowance

Alternative Location 1

120,000 SF

62 Month Lease Term

$1.00/SF Net start rate

3% annual rent escalations

2 months of rent abatement

$0.50/SF tenant improvement allowance

87 Month Lease Term

$0.98/SF Net start rate

3% annual rent escalations

3 months of rent abatement

$1.00/SF tenant improvement allowance

Alternative Location 2

117,500 SF

62 Month Lease Term

$1.00/SF Net start rate

3% annual rent escalations

2 months of rent abatement

$0.50/SF tenant improvement allowance

87 Month Lease Term

$0.98/SF Net start rate

3% annual rent escalations

3 months of rent abatement

$1.00/SF tenant improvement allowance

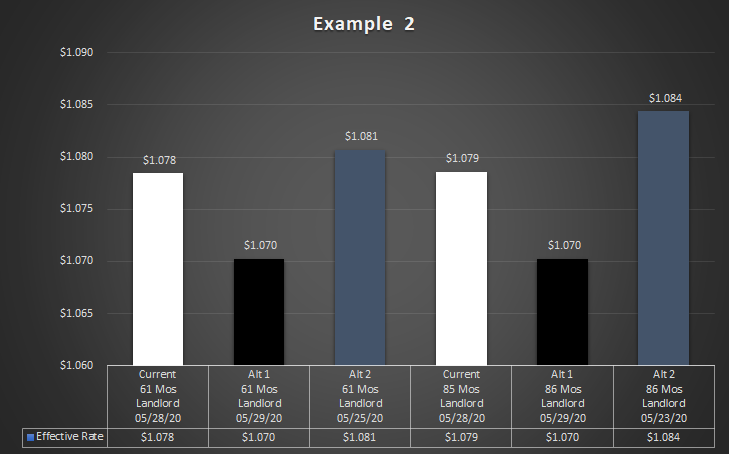

Graphic 2 below outlines the metrics for the initial proposals above, sorted by lease term. Sorting by lease term instead of by property makes it easier to compare options, which can be clearly seen when you look at the table within Graphic 2.

Graphic 2

Even as a description of the initial proposals, Graphic 2 is showing a lot of information which may not be important to the company or customer in comparing the various options. Here I would suggest identifying one or two metrics to focus on since as we add counter proposals there is more information to consider. If the company or customer decides to focus on effective rate, we can revise Graphic 2 to show just that metric.

Graphic 3

Now that Graphic 3 shows only the effective rate for the initial proposals sorted by lease term, it is easier to see that the tenant has offered a premium to their current landlord, perhaps because it is a better building than the alternatives or they don't want to be overly aggressive in their initial proposal, than they have to the alternative spaces. It is also apparent that the proposals for the alternative spaces have the same effective rate for similar lease terms.

Let's assume each landlord reviews these proposals and responds to both proposed lease terms as follows:

Current Location

115,286 SF

61 Month Lease Term

$1.03/SF Net start rate

3% annual rent escalations

1 month of rent abatement

No tenant improvement allowance

85 Month Lease Term

$1.00/SF Net start rate

3% annual rent escalations

1 months of rent abatement

$0.50/SF tenant improvement allowance

Alternative Location 1

120,000 SF

61 Month Lease Term

$1.03/SF Net start rate

3% annual rent escalations

1 months of rent abatement

$0.50/SF tenant improvement allowance

86 Month Lease Term

$1.00/SF Net start rate

3% annual rent escalations

2 months of rent abatement

$0.75/SF tenant improvement allowance

Alternative Location 2

117,500 SF

61 Month Lease Term

$1.04/SF Net start rate

3% annual rent escalations

1 months of rent abatement

$0.50/SF tenant improvement allowance

86 Month Lease Term

$1.02/SF Net start rate

3% annual rent escalations

2 months of rent abatement

$1.00/SF tenant improvement allowance

Graphic 4

Graphic 4 above shows the effective rates for:

the initial Tenant offer for the current and both alternative spaces

the Landlord's counter offer for the current space and both alternative spaces.

Graphic 4 shows that there is a spread between the initial Tenant offer and initial Landlord counter offer, with the later being obviously higher in all cases. To evaluate each offer based on the Landlord counter offer, Graphic 5 below only shows the effective rate for those proposals.

Graphic 5

Based on the effective rate of each Landlord's counter offer, we can see that Alternative 1 has the lowest effective rate on both a 61 month and 86 month term. This is significant, not only because the effective rate is lower than the alternatives, but also because the effective rate is essentially equal for both terms in Alternative 1, where the longer term effective rate is slightly higher for the Current space and Alternative 2.

From Example 1, we know that since the effective rates are so close despite the variance of term, all of the Landlord's counter offers for the +/-84 month terms have lower start rates, greater rent abatement, larger tenant improvements, or a combination thereof in comparison to the +/-60 month options. This is not atypical in most marketplaces where landlords will typically incentivize the tenants to sign longer term leases if possible.

These examples are purely hypothetical with the exception of the actual 60 month renewal detailed in Example 1. However, each example shows how you might want to evaluate your company or customer's lease term options based only on the real estate metrics. I hope they have clearly showed that lease term is an important consideration when evaluating commercial real estate leases and likely more important when there is operational context provided by the company or customer.

In the next post I will take a look at the lease termination option and its implications for both the tenant and landlord in a commercial real estate lease structure. Until then, I would appreciate any questions or comments you might have on this post. Thanks.

Just Hit Go today to discuss our process to make sure a proposed lease term is fair, has appropriate trade-offs, and makes sense for your company’s operation!