Why Some Commercial Real Estate Lease Structures are Better than Others-The Starting Rental Rate

Starting rental rates are by far the most used indicator of pricing in commercial real estate. They allow interested parties to quickly gauge how expensive a property might be to lease and how the leasing cost of one property compares to the leasing cost of another.

So what is a starting rental rate? Simply, it is the amount of base rent paid during the first time period divided by the rentable square footage of the space being leased. The first time period is usually monthly or annual. The starting rental rate is sometimes referred to as the starting lease rate, contract rate, or just the starting rate.

Starting rental rates are usually described as being net or gross. A net starting rental rate is typically understood to be the base rent net of any real estate operating expenses such as property taxes, property insurance, and maintenance costs. A gross starting rental rate would typically be understood as including the base rent and any real estate operating costs for the first or base year.

Whether described as net or gross, do not assume all real estate operating costs are included or not included. For example, some net leases will be net of property taxes and property insurance costs, but include some maintenance costs in the base rent. Such net leases are called modified net leases.

Some gross leases will include base rent and real estate operating costs except certain costs borne by the landlord. Such gross leases are called modified gross leases. Despite the usefulness of describing starting rental rates as gross or net, given the variability in responsibilities for certain costs there is no substitute for reading the lease in question.

The asking and actual starting rental rate is the most common pricing metric in commercial real estate marketing, research, and transactional record keeping. For example:

When an asking rental rate is published by a property owner, they are providing the starting rental rate they hope to achieve

When someone asks, "What lease rate did you get?" in reference to a commercial real estate deal, it is understood they are asking, "What is the starting rental rate you achieved?"

When commercial real estate market reports track the increase and decrease in real estate leasing costs, they almost always will measure the variance in asking starting rental rates from one time period to another

The reason for the starting rental rate's frequent usage is it is easy to standardize and quantify. It does not require any assumptions, math, or interpretation. Only descriptions, such as net or gross and annual or monthly, are necessary. Set arbitrarily by market participants, the starting rental rate is one of the foundational financial figures in commercial real estate.

However, for these reasons the starting rental rate should be viewed with caution. It does not measure the other business terms and conditions of the lease in question nor, as we pointed out before, can we assume it accurately describes base rent and real estate operating expenses.

In order to include differences in operating expenses between options, starting rental rates should be shown on an "all-in" gross basis whenever comparative evaluations are made. Real estate operating expenses vary by market and therefore the importance of converting net starting rental rates to gross starting rental rates also varies, but even small differences can be significant over a lease term.

The starting rental rate is one of seven foundational figures that describe the number and timing of real estate cash flows under an industrial lease:

Rentable Square Footage

Starting Rental Rate

Real Estate Operating Expenses

Lease Term

Rent Adjustments

Rent Abatement

Capital Contributions*

*Capital contributions would include tenant improvement allowances, tenant improvement expenditures, moving allowances and other cash flows typically noted as occurring at Period 0

The impact of changes in starting rental rates depend on whether the other six foundational figures remain constant or change as well. If all other figures remain constant, the following rules apply:

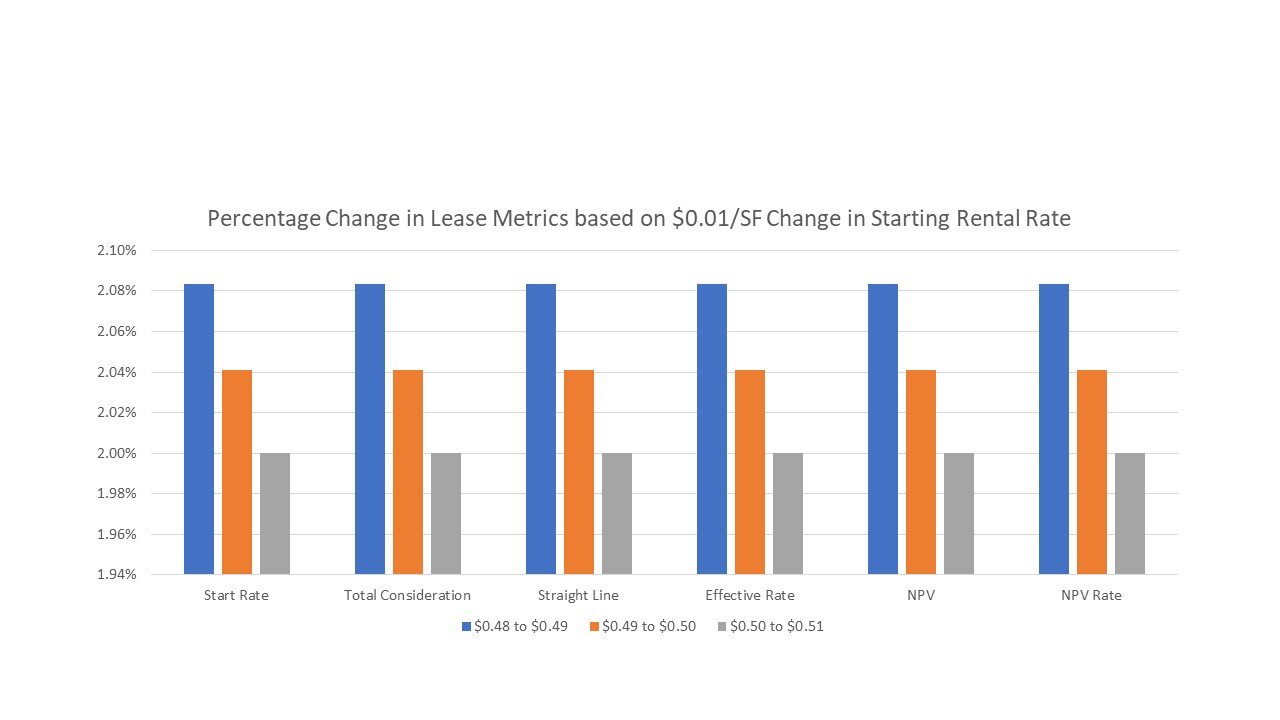

Any percentage change in starting rental rates will also apply to any cash flow metric such as total consideration, straight-line, effective rental rate, net present value (NPV), or the NPV rate

Any percentage change in starting rental rates and cash flow metrics will grow smaller as the starting rental rates increase

Assumes 60 month lease term, no rent abatement, 3% rent increases, and no capital contributions

Any fixed change in starting rental rates will also result in a fixed change in any cash flow metric

Assumes 100,000 RSF, 60 month lease term, no rent abatement, 3% rent increases and no capital contributions

The above rules useful when trying to quickly calculate the impact of starting rental rate changes on cash flow metrics. If you want to know what an increase to a starting rental rate will do to the total consideration of a lease, you only need to calculate the percentage difference between the original and increased starting rental rate, add 1, and multiply by the total consideration to get your answer.

Furthermore, if you want to know by how much the cash flow metric of a lease increases or decreases if you change the starting rental rate by a $0.01, I only need to calculate the dollar amount of change in the cash flow metric once and that amount applies to any starting rental rate increase or decrease of a $0.01.

These rules are also useful when comparing trade-offs. For example, if you calculate that increasing the starting rental rate by $0.01 results in an increase in total consideration of $70,000, and the starting gross rent is $40,000 per month, it probably does not make sense to trade the $0.01 increase for a month of rent abatement.

In practice, starting rental rates are often raised and lowered by tenants and landlords as trade-offs for increases or decreases in other foundational figures. Tenants will sometimes want to structure a lease where the starting rental rate is lower than the market starting rental rate, in exchange for greater than market rent adjustments over the lease term. Such tenants may be concerned about the amount of start-up costs of their operations but not its future viability to handle larger real estate costs.

If the landlord will consider such an alternative rent structure, the real estate cash flows can be engineered so the Tenant's desired starting rent will result in an NPV effectively equal to the NPV of a market rental structure.

Proposal 1 has a market rent of $190,000 per annum with no increases. Proposal 2 shows a below mark starting rent in exchange for larger rent increase over the term. Both Proposals have equivalent net present values at 6%.

Some landlords will value the starting rental rate more than other foundational figures and will willingly trade higher starting rental rates for other concessions such as rent abatement. Such landlords are motivated by increasing property values based on annual net operating incomes, so trading concessions early in a lease in exchange for higher annual net operating incomes later is usually desirable.

This is an extreme example since there is $0.05/SF difference between what the Tenant and Landlord are willing to accept for a start rate.

Starting rental rates are important indicators of pricing within commercial real estate. Their impact on real estate cash flows should not be understated, but as with other foundational figures they should be viewed as a part of the cash flows resulting from the lease of commercial real estate.

Just Hit Go to talk about how we can creatively explore alternative real estate lease structures for your company today!